A tax identification number (TIN) is a unique number issued to businesses, incorporated companies, and individuals in Nigeria and other nations for tax purposes. In Nigeria, the TIN is a unique 10-digit number generated by the Joint Tax Board for the purpose of proper identification, tracking and to ensure than more people are brought under the tax net.

How do you get your TIN? In this article, I would be teaching you how to get your TIN and the two different types of TIN we have.

In collaboration with the Joint Tax Board, the Federal Inland Revenue Service (FIRS) of the Nigeria is responsible for the issuance of tax identification numbers to Nigerians and anyone who does business in Nigeria.

The Tax Identification Number is usually issued by the Tax Authority, either online through the Joint Tax Board portal or via a letter to the Federal Inland Revenue Service office closest to your location. Below is a certificate of tax identification number which would be emailed to you by the Joint Tax Board once your TIN generation process is complete.

Tax Identification Number Example

We have two types of Tax Identification Numbers, namely;

- TIN for Individuals

- TIN for Non-individuals (i.e for Companies, Businesses, and Organizations)

TIN Registration Process for Individuals

If you have a National Identification Number (NIN) or Bank Verification Number (BVN), you may already have been issued a Tax Identification Number (TIN). Before proceeding to register for a TIN, it is always a good idea check whether or not you already have a TIN.

How to confirm if you have a TIN:

- Check the Joint Tax Board TIN Verification Page.

- Select your date of birth.

- Select your preferred search criteria (BVN, NIN or registered mobile number) from the drop-down menu.

- Enter the digits of the search criteria you selected in the previous step. e.g. if you selected NIN in STEP 3: enter your National Identification Number in the Search Value field below.

- Click the reCAPTCHA box to verify that you are not a robot.

- Click search to get your TIN

If it says “RECORD NOT FOUND,” you should try using other search criteria. But if despite that, you are still unable to find your TIN, then you can proceed with your TIN registeration to have your TIN generated.

How To Generate TIN for Individuals

As an Individual, you can only apply for TIN by visiting the Federal Inland Revenue Service (FIRS) office nearest to you. From my observation, the JTB portal currently only allows you to check if you have an existing TIN.

Subscribe for updates

Before taking a trip to the nearest FIRS office to generate your TIN, remember to take the following documents with you;

- Your NIN (National Identification Number) Slip or any other government-issued ID Card

- BVN (Bank Verification Number)

- Utility Bill

- Passport Photograph.

TIN Registration Process for Non-Individuals

If you have already registered your business or incorporated company with the Corporate Affairs Commission (CAC), then chances are good that you already have a TIN. So, before you proceed with applying for a Tax Identification Number for your organization, you should first confirm if you already have one.

How to confirm if your business has a TIN (Non-individuals):

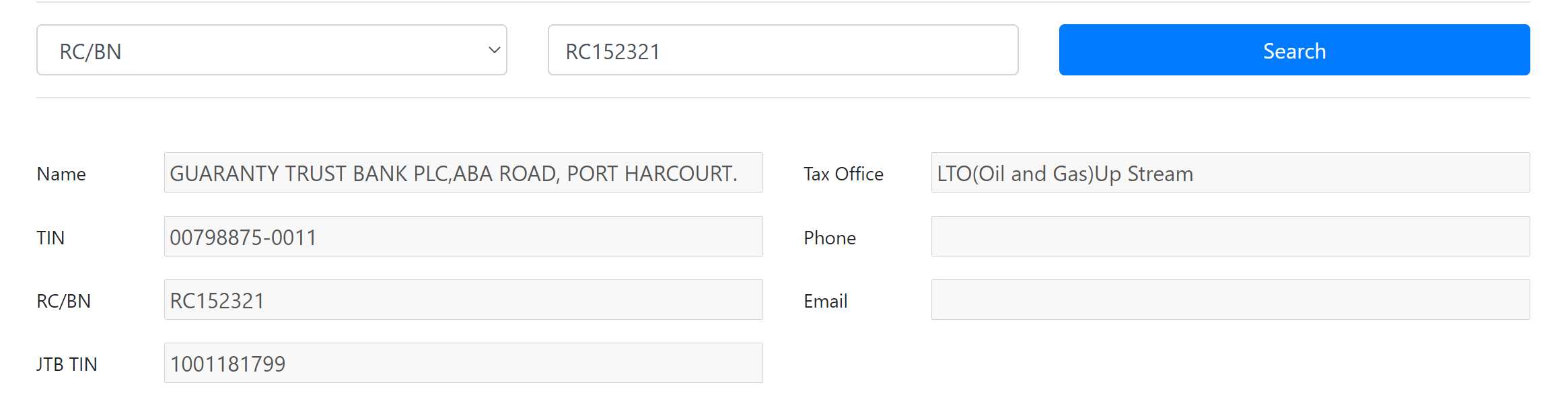

Here’s the easiest and fastest way to verify if your organization already has a TIN. This process also allows you to know what the TIN number is.

NOTE: To get a TIN for your organization, it must have already been registered with the CAC.

- Visit the FIRS TIN Verification System Page

- Select RC/BN from the Search Criteria dropdown menu

- Enter your organization’s RC or BN number in this format: RC1234578 or BN1234578

- Click on the Search button.

As you can see in the example below, I have used GTCO’s (formerly GTBank) RC Number which I found on Google to pull those details from the FIRS Database.

⚠ I am sharing this for educational purpose only. I shall not claim responsibility for whatever you decide to do with it. Please use this feature responsibly.

TIN Verification for Non individuals using RC or BN Number

If the system cannot find your record, then you may go ahead and apply for a TIN.

How To Generate TIN for Non-individuals

Non-individials (such as Limited Liability Companies, Incorporated Trustees, Enterprises, Cooperative Society, MDAs, Trade Association etc) are the major beneficiaries of online TIN registration as the process can be completely carried out online without visiting the nearest FIRS office.

Non Individuals can request for their TIN online by visiting the JTB TIN Request page.

Your request will be verified and if approved, your TIN Certificate will be sent automatically to registered email address.

I hope I have helped you with this little piece of information. Thanks a lot for reading.